Investor Access

Access your existing account

SaveDaily is an open architecture modular platform designed to create offerings that you can customize and deliver with flexible features and pricing. There's no need to struggle with legacy technology to deliver innovative propositions.

The SaveDaily Platform automates the entire client lifecycle and is designed to be integrated through your existing and future client touch points.

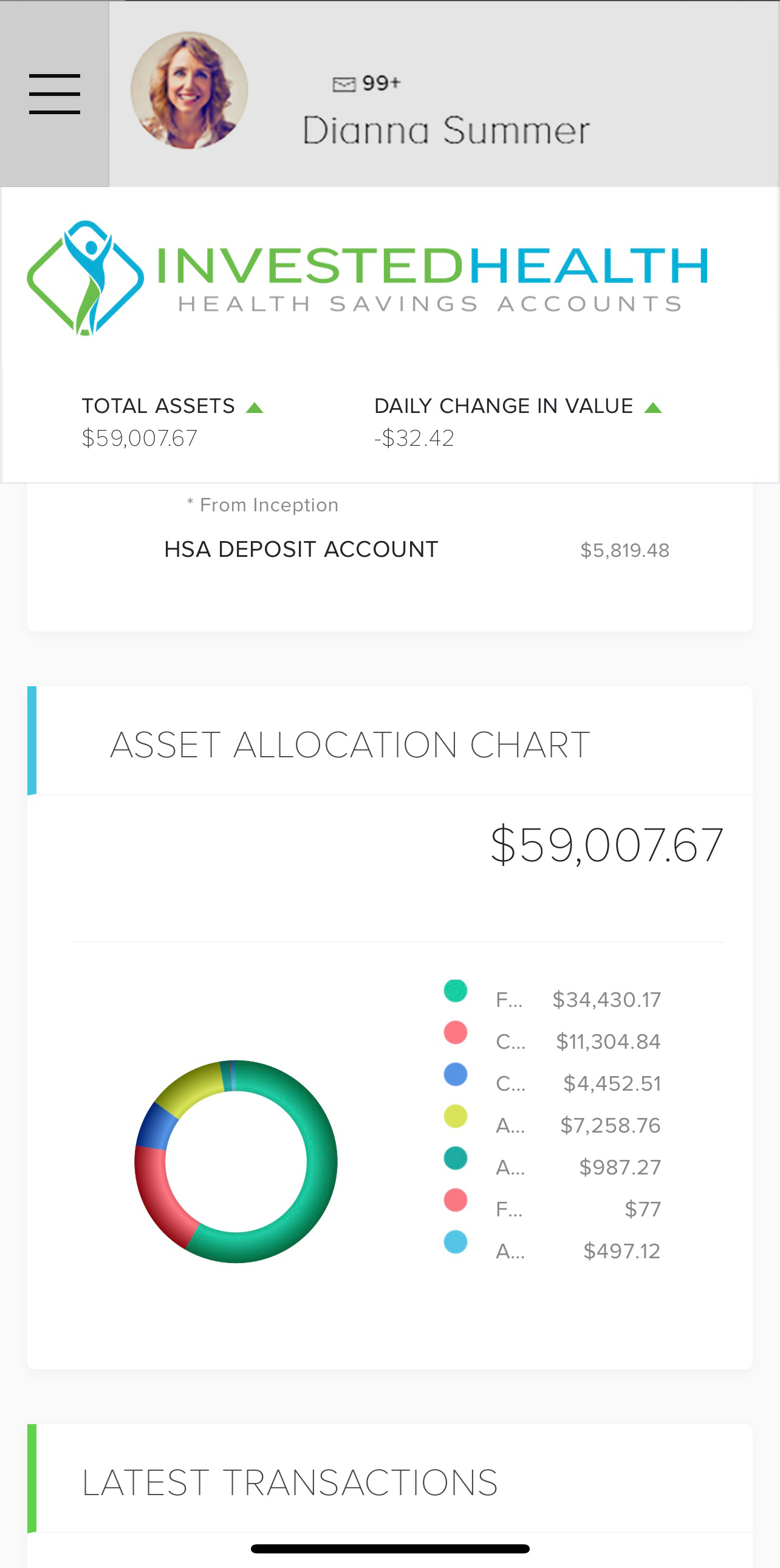

Invested Health

Credit Card Overlay

Robo Advisor

Technology Reporting

Pension Offering

High-Net Worth

Mass Affluent

Insurance Wrapped

The Savedaily platform offers a full online, paperless, technology suite licensed as a white-label platform with Single Sign-On capabilities that is distributed by its financial partners, including banks, insurance companies, broker-dealers, and registered investment advisors.

HSA is a tax-advantaged account created for individuals who are covered under high-deductible health plans (HDHPs) to save for qualified medical expenses that are over and above an HDHPs coverage limits and/or exclusions.

You own your HSA account, not your employer. However, your employer may make contributions to your account. Family members can too.

Our solutions combine intuitive technology with remarkable service, enabling you to simplify the experience and empower your people to achieve more.

InvestedHealth is an intuitive, simple, and independent HSA. We provide unparalleled customer service and go above and beyond at every step to ensure client satisfaction.

Our Credit card Module provides the bank partner an innovative fin tech solution for credit card customers to seamlessly have a API based investment account tied to their credit card for cash back, round up and other strategies.

We offer unique marketing campaigns that help bank partners create investment clients from credit card only clients.

Our complete web-based paperless daily savings/investment platform automates the entire investment process and can be implemented with the web-hosted or API model.

Simple Risk assessment wizards and easy to use web interfaces help potential first time investors (existing credit card customers) determine the most suitable investment portfolio and invest automatically after using their credit card.

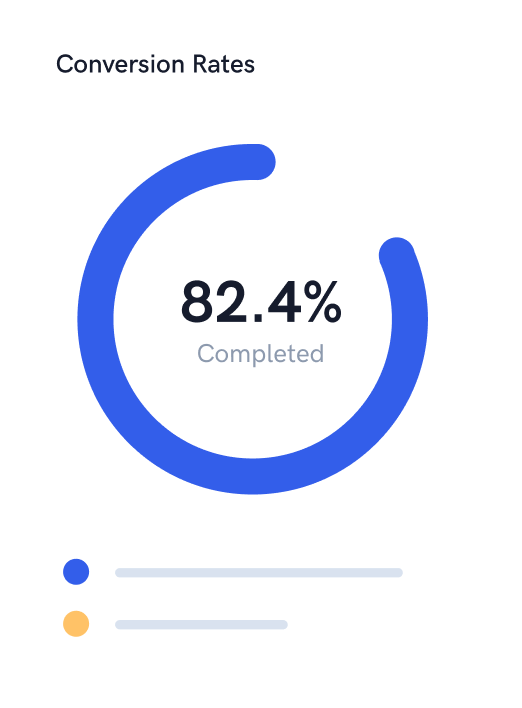

Our Robo Investing module provides the bank partner a seamless digital bank investment solution that utilizes Artificial Intelligence to manage the investment asset allocation process.

Young/Unpracticed investors benefit from the bank partner digital app (a fully automated on-line investing investment experience tailored by AI) with a turn-key simple investment solution.

Leading Artificial intelligence solutions provides the investor access to model portfolios that are rebalanced on a weekly basis to reduce the volatility and risk within the investors portfolio.

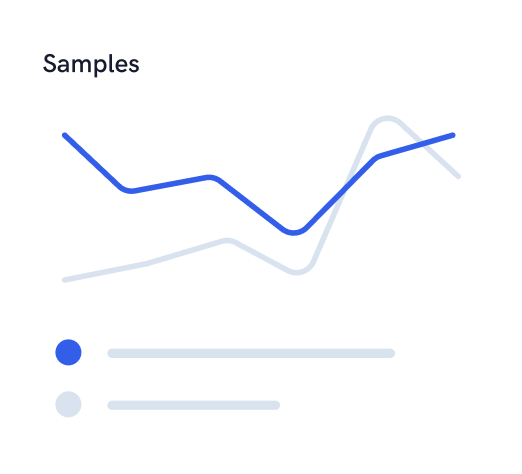

Complete on-line reporting and statements provide the investor the information to monitor their investment performance and add additional funds on a standing instruction or ad hoc basis.

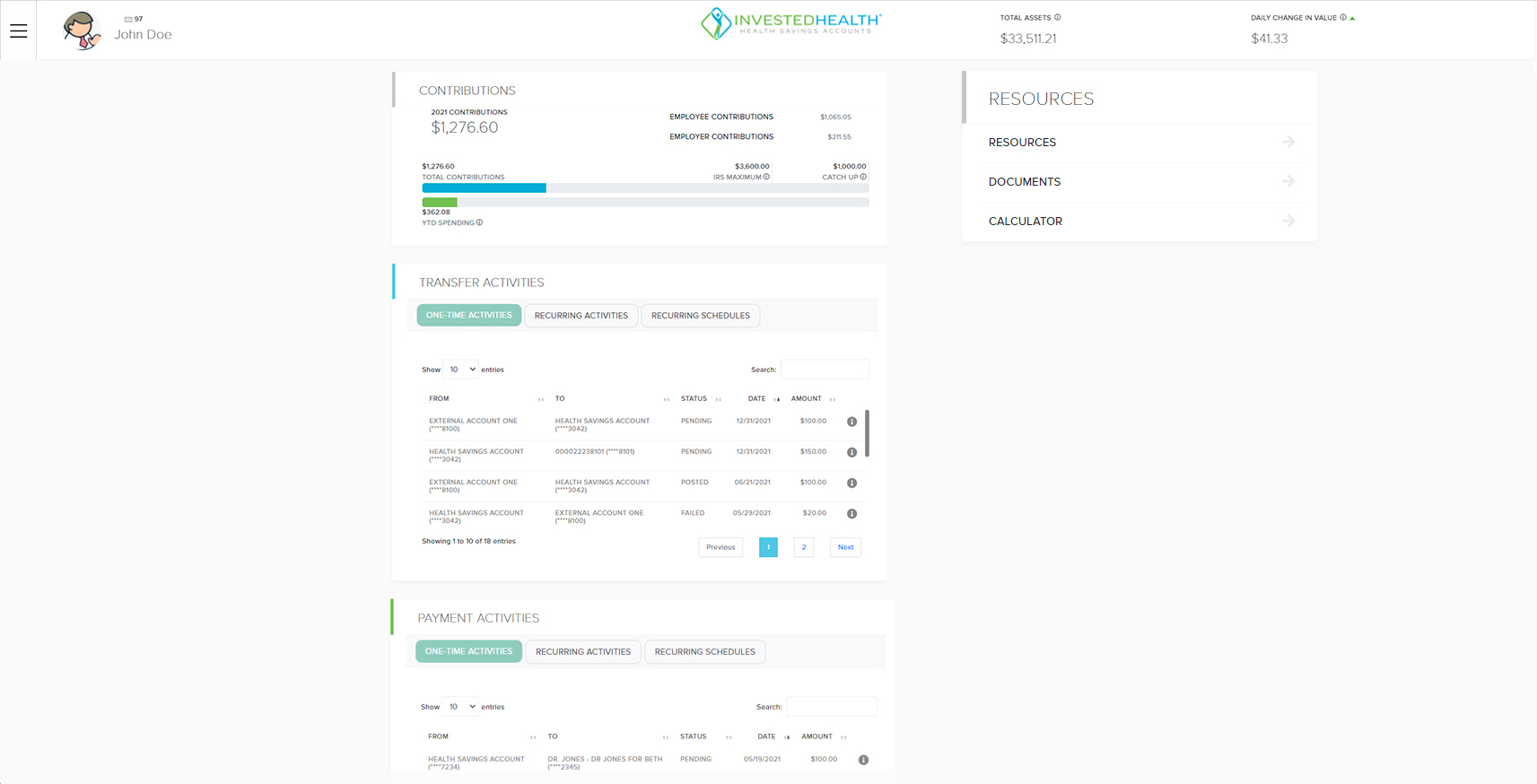

Full technology reporting engine to support or replace existing account management/reporting tools and web interfaces while BANK maintains chains of custody and clearing relationships keeping revenues in tact.

Internal customers views and data points provided to all departments in a single real time dashboard.

Integrated access to tala customer data view that can be adjusted to accommodate custom builds and integrations.

Facilitate machine learning and deep learning technologies via single data set model.

Our Pension Module provides a complete on-line, paperless pension solution for our bank partners and their corporate clients (employer, employee).

Processing of employee enrollment forms and handle automatic enrollments via inbound contribution data. Vesting management, unlimited employee trading with no minimums, and automatic portfolio rebalancing. Pension plan rules maintained online and processed on employer’s behalf.

Includes a fully automated/paperless onboarding process for the bank partner to manage the the employer/employees – including vesting schedules, loans, asset allocation model portfolios.

Modeled after the tested SaveDaily 401k US pension system for the largest US employers –the bank partner can leverage off the leading technology in the US pension industry anywhere on the Globe.

Our High Net Worth Module provides a complete web-based paperless solution for private client/private bank segment.

Individual daily priced bonds, fixed income securities as well as mutual fund holdings to provide a complete digital bank investment solution.

Complete on-line reporting and statements provide the investor the information to monitor their investment performance and add additional funds on a standing instruction or ad hoc basis.z

SaveDaily can work with multiple custodians for the high net worth client to offer the most robust solution. This module can implemented with the web-hosted or API model with the partner institution.

Our Mass Market/Mass Affluent Module provides a complete web-based paperless daily savings platform that automates the entire investment process for the investor/client services desk.

Asset allocation models, on-line risk profiling and flexible pricing options can be customized for the bank partners. Cost efficient client onboarding allows bank partners to reach the mass market segment with a mobile/online interactive daily savings platform.

Client service desks at the institution can utilize the online tools to help support the onboarding of customers and leverage the technology and reporting to offer a turn-key pre and post sale service financial technology solution without the use of financial advisors.

Complete on-line reporting and statements provide the investor the information to monitor their investment performance and add additional funds on a standing instruction or ad hoc basis.

Our Robo Investing module provides the bank partner a seamless digital bank investment solution that utilizes Artificial Intelligence to manage the investment asset allocation process.

Young/Unpracticed investors benefit from the bank partner digital app (a fully automated on-line investing investment experience tailored by AI) with a turn-key simple investment solution.

Leading Artificial intelligence solutions provides the investor access to model portfolios that are rebalanced on a weekly basis to reduce the volatility and risk within the investors portfolio.

Complete on-line reporting and statements provide the investor the information to monitor their investment performance and add additional funds on a standing instruction or ad hoc basis.

SaveDaily is an API-based Financial technology firm that allows clients to invest as little as $5 at a time into mutual funds — without imposing a requirement for additional contributions

Customized Portfolios

Automatic Rebalancing

No Trading Fees

Unlimited Trading

SaveDaily’s low-cost, private label platform enables banks, brokerages, and non-traditional financial service providers to profitably offer high-end financial services to anyone, regardless of income, account size, or activity levels.

SaveDaily offers investment and record-keeping services to its intermediary partners, as well as directly to clients through a variety of white-labeled interfaces. Through SaveDaily's proprietary technology, clients can expect a cost-efficient, high-quality investment portfolio to everyday savers everywhere.

Get In Touch

Stop wasting time trying to do it the "right way" and build your app from scratch. Dashkit is faster, easier, and you still have complete control.

Get In Touch