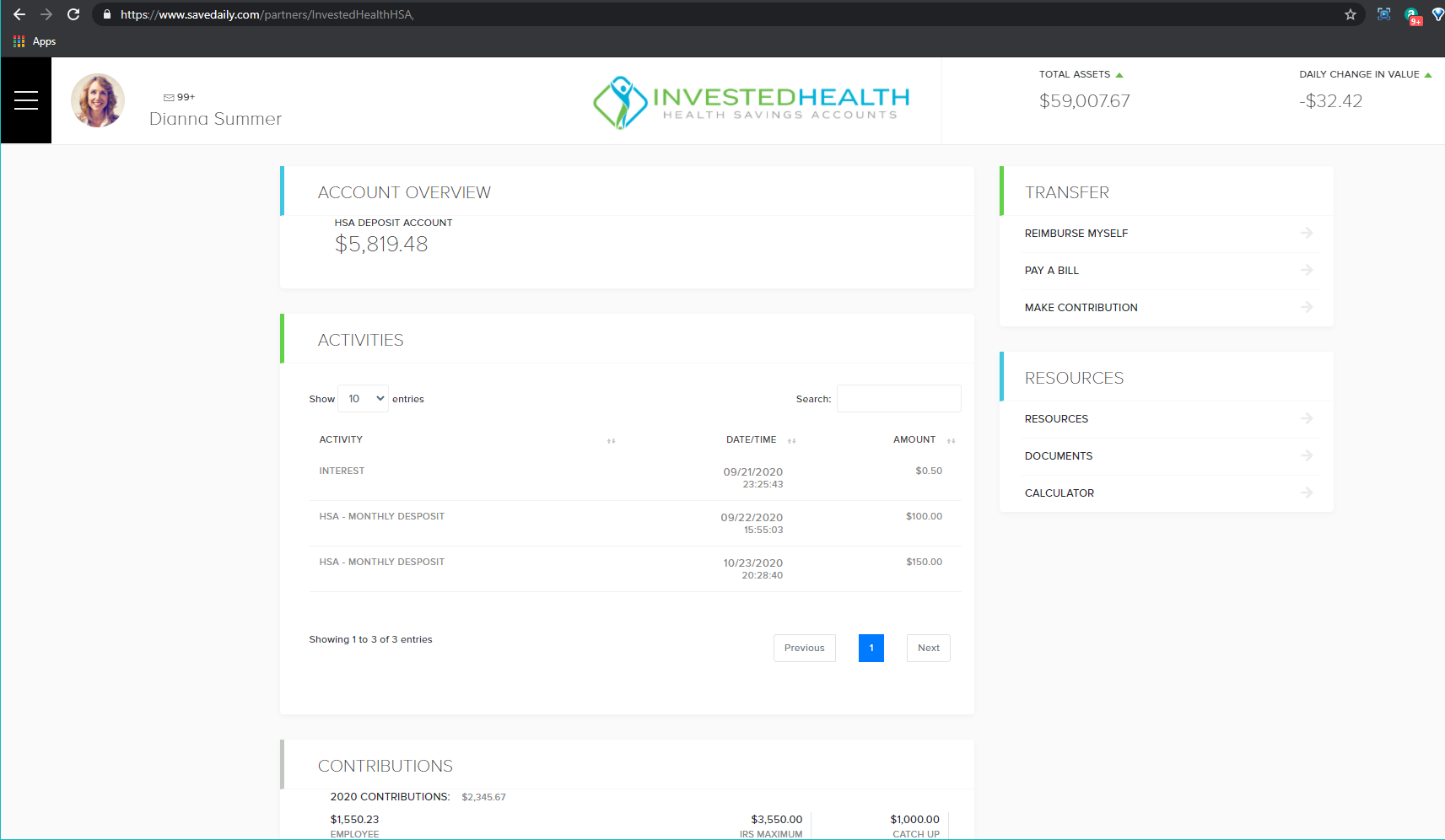

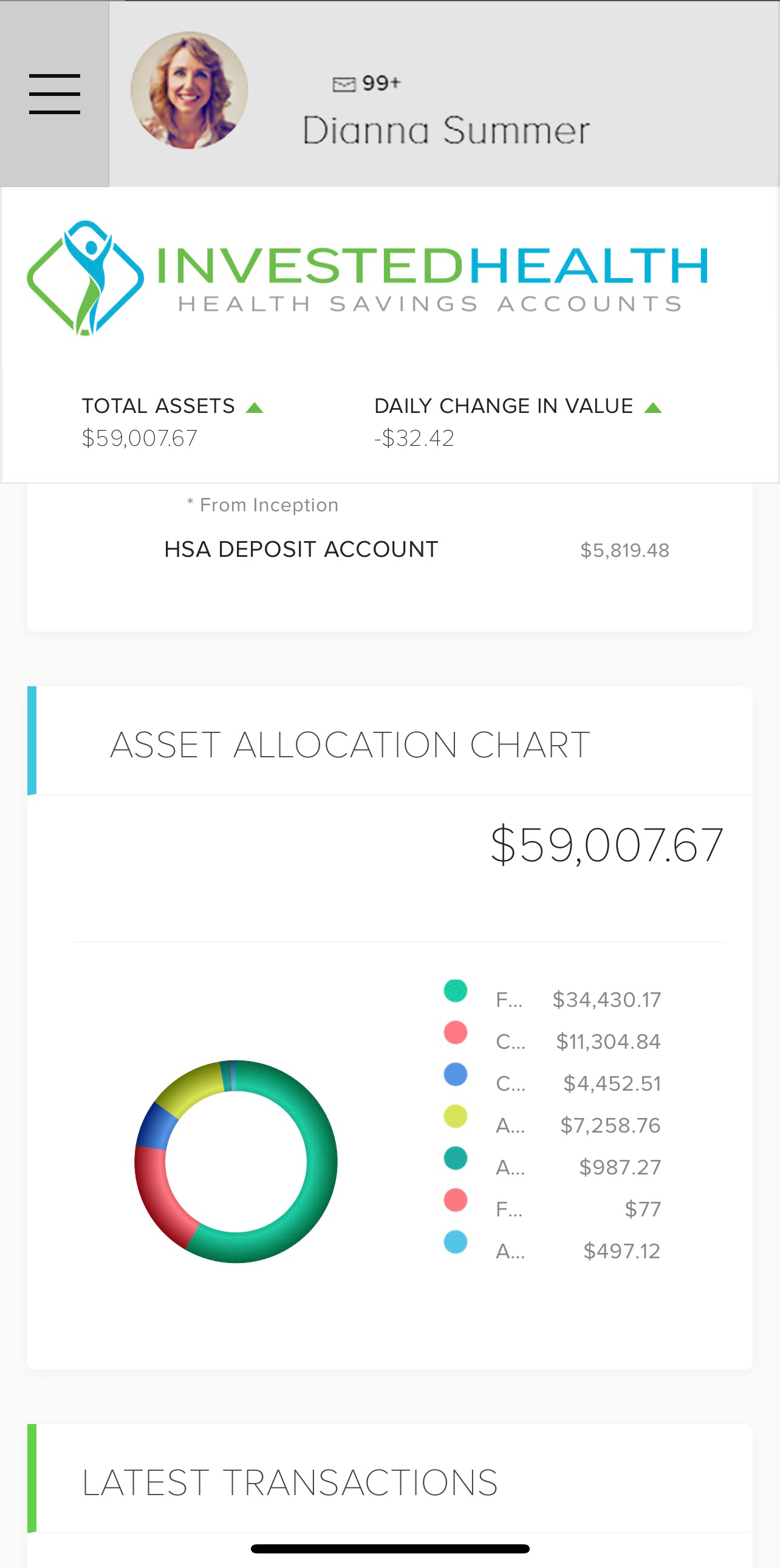

InvestedHealth.

One total solution.

Simplify benefits and impact people’s lives. Our integrated solutions help build better benefits packages.

Schedule a demo